Asset financing

Traditional finance leasing with its pay-as-you-earn principle already offers flexible financing solutions for SMEs.

However, our M.A.i flexpay option is afurther development that exploits the possibilities of digitalization.

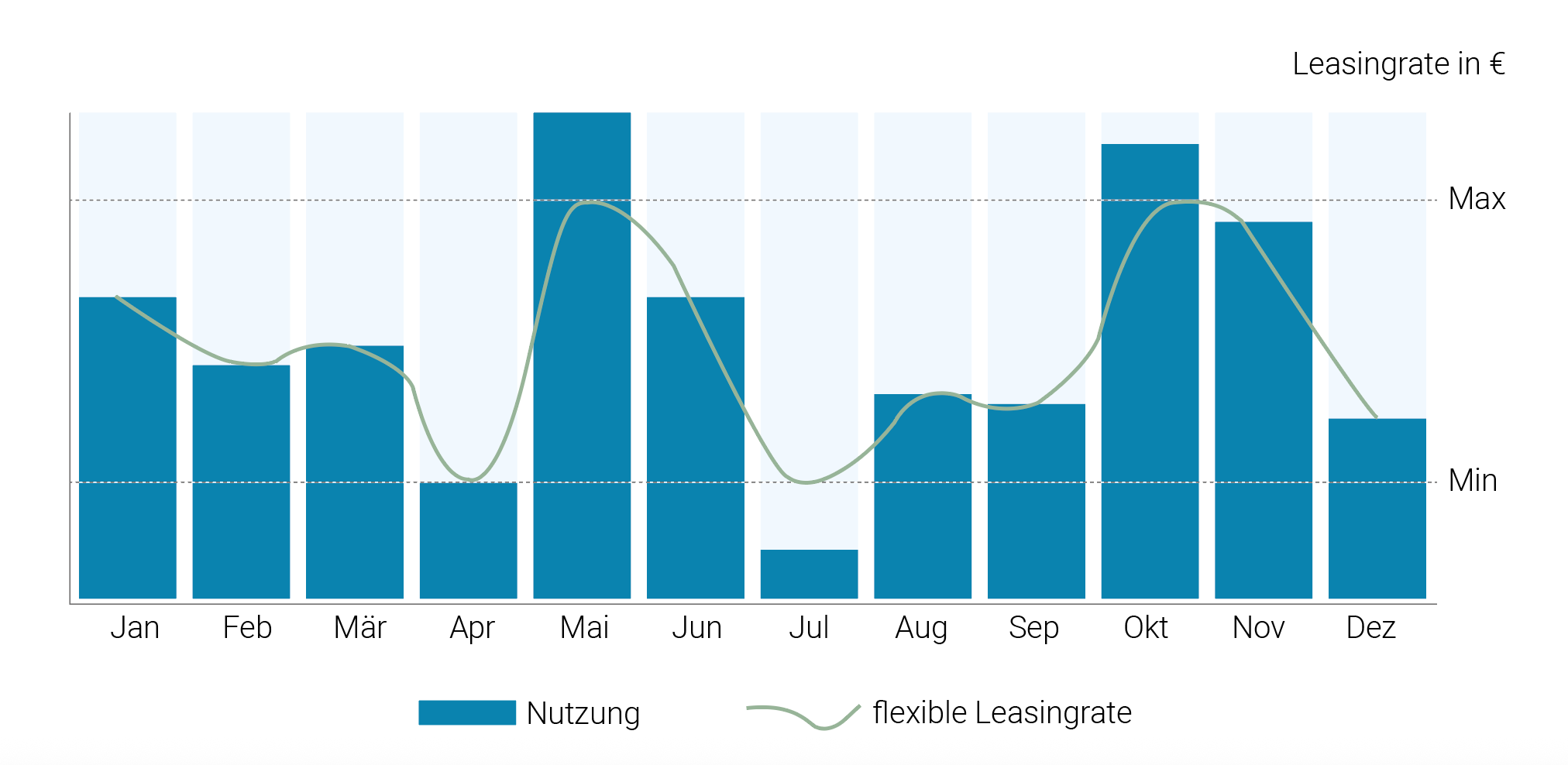

Instead of paying predetermined installments that are based on a While M.A.i flexpay is based on the estimated use of the investment object, M.A.i flexpay measures and charges the actual use. If machine utilization is high, the rate increases, while it decreases with lower utilization. In this way, the financing adapts dynamically to the economic situation of the company.

Of course, we can also offer you classic financing for your investments – you can find more information here!

Finance flexibly with M.A.i flexpay!

Secure a cost advantage over conventional financing!

| Utilization | per month | Term¹ | Monthly leasing rate |

|---|---|---|---|

| minimum | 130,000 units | 86 months | 11.570,00 € |

| planned | 170,000 units | 61 months | 15.130,00 € |

| maximum | 251,484 units | 39 months | 22.382,08 € |

Calculation example with a purchase value of €800,000, with a deposit of €0 and a residual value of €40,000.

¹When calculating the leasing rate, it is possible that the term is not an integer, i.e. a duration with decimal places. For calculatory reasons, we round these up or down to full months. This adjustment has a slight effect on the calculated residual value of the equipment at the end of the leasing period.

Please note: This example is only intended to illustrate the financing. Statutory fees and incidental costs incurred are not included in this calculation. We will be happy to provide you with a non-binding offer tailored to your personal situation. This would be subject to a credit check by our financing partner. This example does not create a legal obligation.